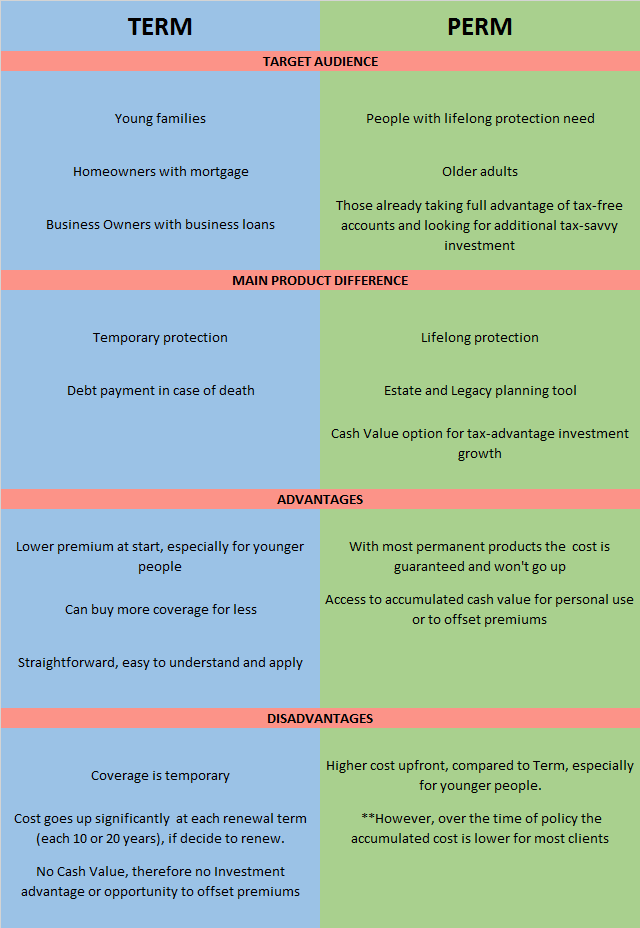

Life Insurance market offers many choices. How to start navigating it without getting lost? To pave the path, first figure out whether you need Term or Permanent product. And let us hold your hand, of course.

Whether you consider Term or Permanent coverage or combination of both, let our professional team create a custom solution for you! Contact us here.